Register to Fundraise in Each State

You’ve decided to start your own non-profit charity to raise money for a cause you are passionate about. This is great, but there is a

You’ve decided to start your own non-profit charity to raise money for a cause you are passionate about. This is great, but there is a

In non-profit finance and accounting, restricted contributions are those given by donors in which the donor intends the funds to be used for specific programs or purposes. As in all matters regarding donations, the stated intent of the donor rules when it comes to the purposes for which donation revenue can be allocated. If the donor allocates funds for program B, and states verbally or in writing that such funds cannot be used for administrative costs (back office, IT support, human resources, insurance, operations, etc.) to support such programming, than they cannot be used for that purpose. However, if no such explicit statement is made by the donor, non-profits can use a reasonable amount of the restricted funds received to pay for administrative costs allocable to the program designated by the donor.

The establishment and maintenance of a nonprofit endowment fund can be a very important factor in ensuring the sustainability of a non-profit corporation. There is a

With the market volatility of the last six months, funding sources and non-profits alike may be uneasy given memories of the 2008 recession. Although predicting future macro-economic forces may be impossible, it is always a good idea for 501(c)(3) non-profit corporations to seek to diversify revenue streams to prepare for shifts in funding.

As of January 1, 2018, Arkansas Charitable Solicitation law was updated, moving registration for charitable solicitation from the Arkansas Attorney General to the Arkansas Secretary

On December 22, 2017, Pennsylvania fundraising laws changed when the Governor signed two bills into law amending the Solicitation of Funds for Charitable Purposes Act.

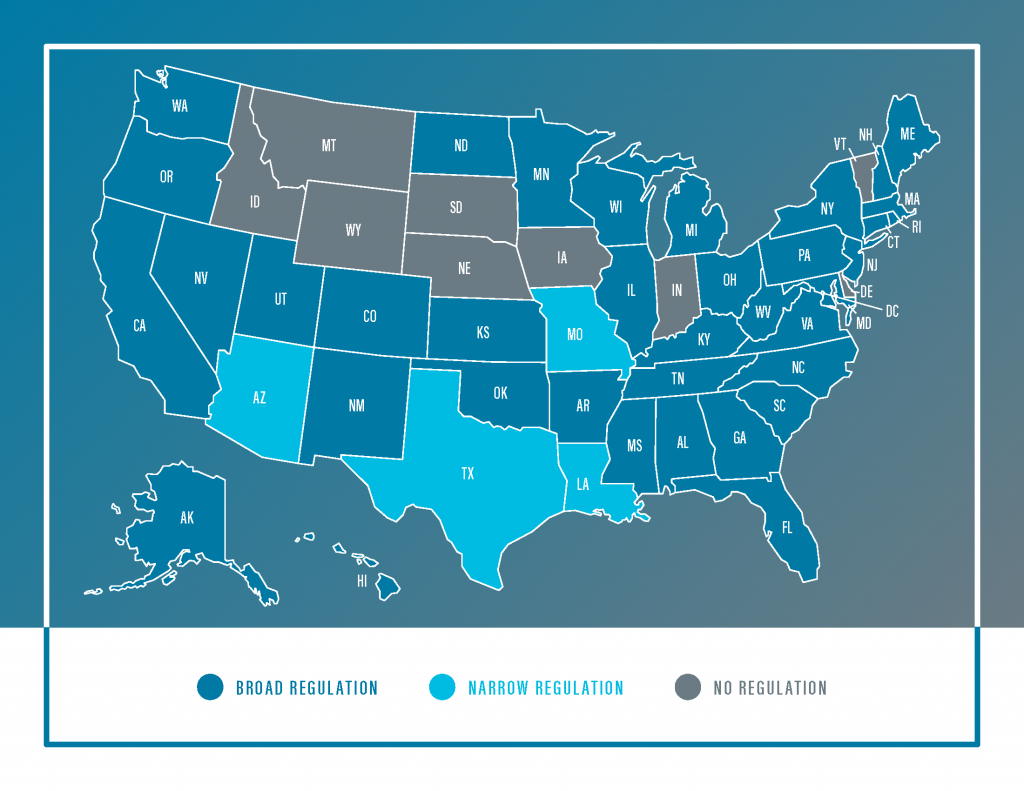

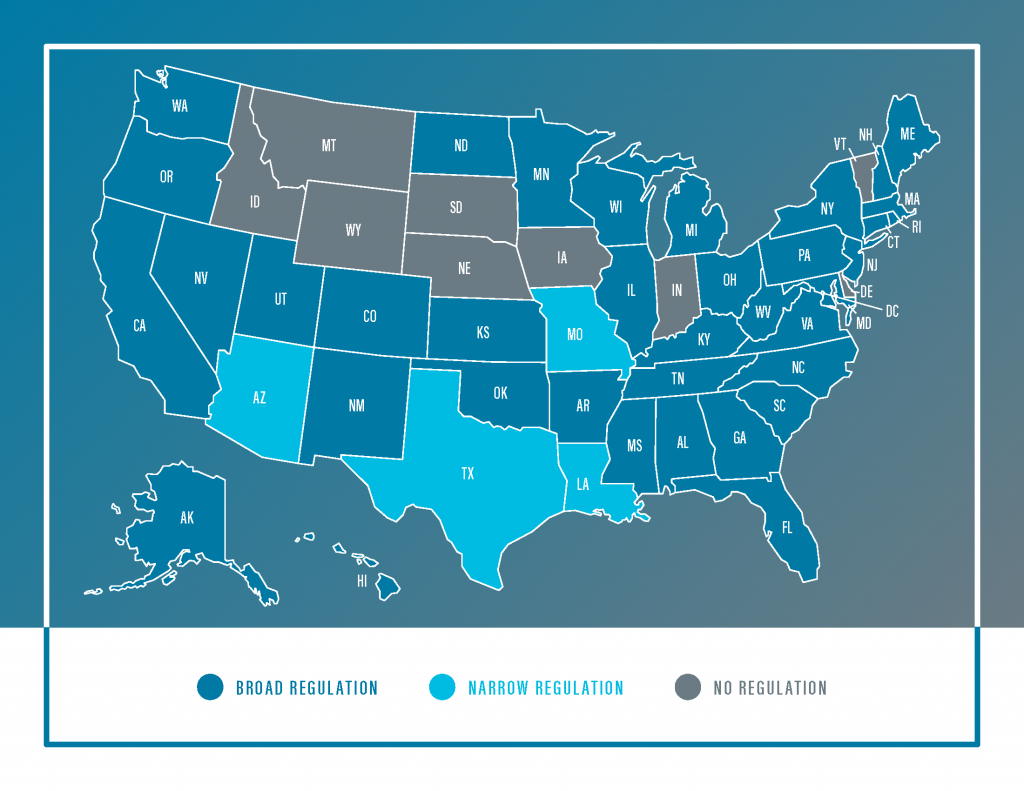

Fundraising to carry-out a nonprofit’s charitable purpose is necessary for the survival of the organization. However, holding a 501(c)(3) tax exemption does not give unlimited

The laws in this area have been evolving and it is getting easier to move a nonprofit’s domicile (or legal home) from one state to another.

Yes, charitable registration laws really do apply to small charities, but there are nonprofit registration strategies that can help keep small organizations in compliance. Many

North Dakota’s Charitable Solicitation Annual Report is due September 1. The Annual Report can be obtained online. Note that North Dakota does not require a

Download our free guide to learn about the many elements needed to run a successful nonprofit organization, as well as how to avoid common pitfalls and mistakes.